Over the period of 2019, Malaysia’s economic growth is on a stable level. Nonetheless, at the beginning of 2020, the global pandemic Covid 19 has disrupted the Malaysian economy which enforces buyers to change their shopping habits as well as retail sectors.

The closure of physical stores due to lockdown and social distancing measures led consumers to ramp up online shopping, which in turn accelerated the e-commerce market growth in Malaysia, according to GlobalData, a leading data and analytics company

>> Read more: Malaysia in 2021: Current trends, growth, and opportunities

The pandemic on the other hand has brought some significant changes in the customer’s needs of Malaysia. With this article, Boxme will lead you through how buyers in Malaysia have changed post Covid-19 period.

>>Read more:Malaysia: The Dominating Ecommerce Market in SEA

Market stability and higher sensitivity to price

There are various factors contributing to the decrease in money spending of the population and changes in customer’s needs of Malaysia. Let’s look at two significant factors

Pre-Covid period, EY had carried out a research on the wishes to spend among the population in Malaysia. The result came back with nearly half of the population 46% wanting to spend more in the next 12 months.

>>Read more: Malaysia in 2021: Current trends, growth, and opportunities

>>Read more: Carousell Malaysia Steps Up Amidst COVID-19 Pandemic

It took the turn when the pandemic hit, as long as the economy was spinning, we witnessed a strong contraction in Malaysia’s GDP by 17.1%, in the second quarter of 2020, the lowest growth in Malaysia since the fourth quarter of 1998.

>> Read more: Malaysia, Your Next E-Commerce Destination

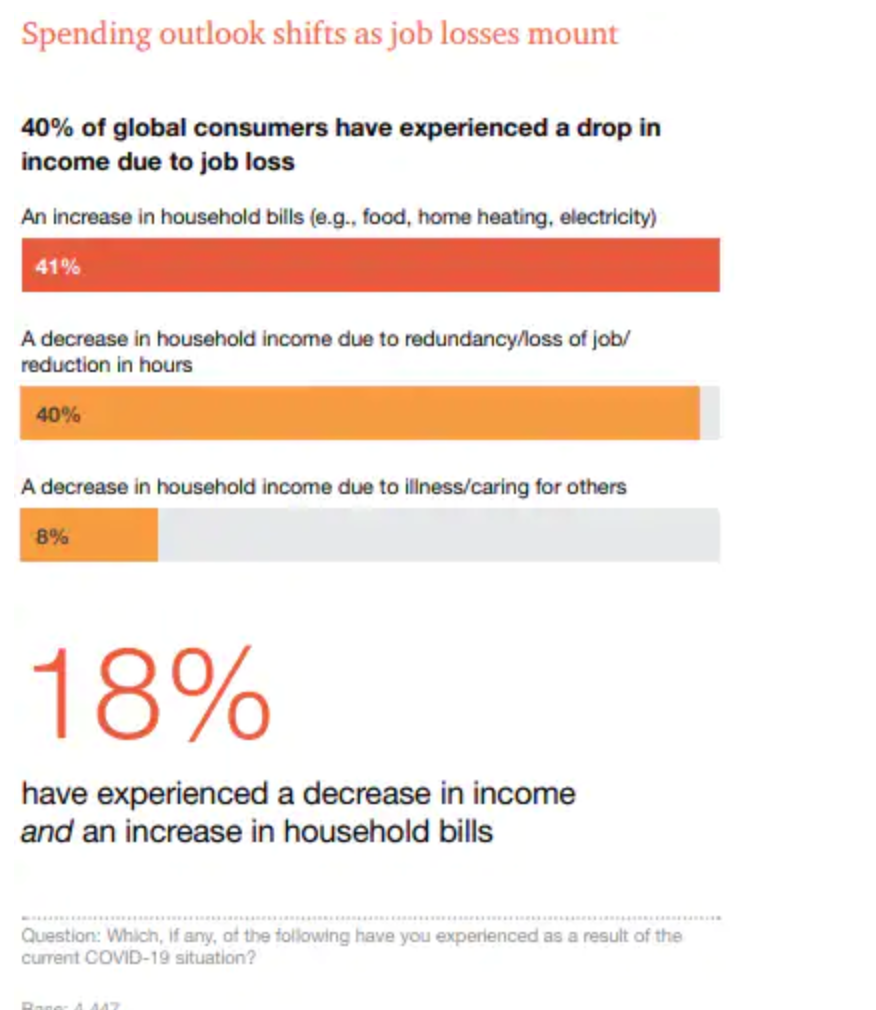

Consequently, 18% of the population report to have a decrease in income, increase in household bills which accordingly cut down spending.

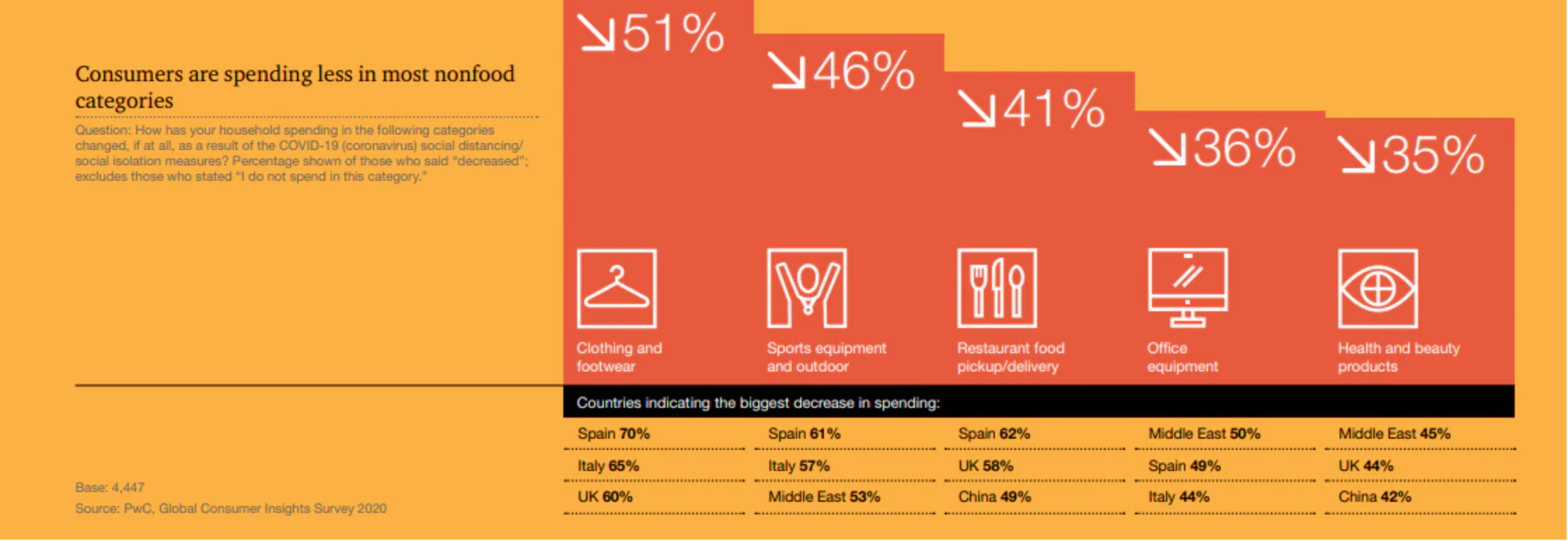

Before the government guidelines on social distancing, customer’s needs of Malaysia mostly spend most of their spending in travel, dining out, art and cultural events, personal styling, health and wellness, nightlife and entertainment, and sporting events. Following the governmental rules on staying at home, these sectors have gradually shifted towards health products and pantry stockpiling.

Nielsen has predicted this trend to continue due to the cautious spending trend to continue especially after the loan moratorium period ends, coupled with the rising unemployment rate.

>> Read more: Malaysia;s Ecommerce Economy Thrives During COVID-19

Mobile-First Audience

Since the stay at home police have been applied, there was a spike in the number of mobile users in Malaysia. It is reported that 80% of mobile users use their devices to shop online. And this number still remain post-Covid 19

>>Read more: Social Commerce: The Rising Trend in Malaysia

Mobile ecommerce transactions in the region are expected to reach $5.6 billion in 2021.

Mobile ecommerce transactions in the region are expected to reach $5.6 billion by 2021. Within the mobile category, apps are the most preferred ecommerce channel and used for 64 percent of transactions

Social Commerce

The rise in usage of smartphones has also led to a spike in social media commerce, especially through WhatsApp and Facebook.

>> Read more: Social Commerce: The Rising Trend in Malaysia

According to the data by Hootsuite, there are over 26 million social media users in January 2020. In just a few months from April 2019 to January 2020, this number of social media users has spiked up of 4,1%, this number is the explicit result of the stay-at-home policy

At the middle of January, it is reported that the social media penetration stood at 81%

The more time people spend surfing on social media, the more they are exposed to Google Ads, Facebook Ads and e-commerce marketplaces. Which in general enhance the overall revenue of the e-commerce business.

Digital pave the way

E-commerce and online shopping, in recent years, is still an ongoing trend in Malaysia.

>> Read more: Malaysia in 2021: Current trends, growth, and opportunities

The pandemic is said to further accelerate the growth of the e-commerce market and reinforce the trend of online shopping in Malaysia and customer’s needs of Malaysia. It has encouraged experimentation, changes in customer’s needs of Malaysia, coaxing consumers to explore different ways to access products and services.

>>Read more: Malaysia, Your Next E-Commerce Destination

At the same time, social distancing policy also expedited the rise of electronic payment. A report by Mastercard recently has proven that consumers in Malaysia are the leaders of cashless payment in the whole SEA with 40%, and ahead of the Philippines with 36% and Thailand with 27%.

>> Read more: Malaysia’s Ecommerce Economy Thrives During COVID-19

Moreover, this trend continues to grow in the next few months of 2020 with over 149% surge in online sales and is predicted to keep this pace till 2021. There are some stand out names that have earned a big win this year such as Shopee pulled in an average of over 27 million visits.

Shifting in retail sectors and customer’s needs of Malaysia

In the first few months of the pandemic, customer’s need of Malaysia has gradually shifted their buying habits from beauty, electronics towards essentials goods and groceries

> Read more: E-commerce Fashion Industry in Malaysia 2020 – 2021

>> Read more: 3 E-commerce Cosmetics Market Trends in Malaysia 2020

In a recent survey by EY prior to the pandemic, “almost half of the world’s urban consumers indicated they were making dietary changes (taking supplements, implementing plant-based food options or restricting certain food groups) in an effort to adopt a healthier lifestyle. After the outbreak, we found a huge, renewed focus not only on diet, but on the holistic concept of healthy living”

The shifting in customer’s need of Malaysia clearly reflected in regional businesses which demand them to quickly adapt to the changes. Lazada Malaysia has quickly adjust with the changes by launching a sales campaign, offering discounts and vouchers on their platform.

Annual Sales season

Malaysians shop online in preparation for major holidays, especially Chinese New Year and Ramadan. On these occasions, the customer’s needs of Malaysia in shopping definitely surged and people tend to look for saving money in bulk and especially for discounts.

> Read more: Trends and Insights for Chinese New Year 2021 in Malaysia

>>Read more: How Malaysians Shopped Online For Chinese New Year 2021

On these events, e-commerce marketplaces constantly roll out attractive gifts, sales events to cater the customer’ requirement and strongly enhance the over year’s revenue.

>> Read more: 12.12 Sale In Malaysia Break E-commerce Records

>> Read more: 5 Tips on How to Boost Sales on Shopee in Malaysia

Besides this, Malaysia has three major annual national shopping events—Malaysia Super Sale (March 1–31), Malaysia Mega Sale Carnival (June 15–August 31) and Malaysia Year-End Sale (November 1–December 31). International discount shopping events Singles’ Day and Black Friday in November are also rising in popularity.

>> Read more: How Malaysia Handled the 11.11 Sale 2020 Campaigns

As noted by George Bernard Shaw “ don’t wait for the right opportunity, create it”. The pandemic certainly has highlighted the importance of being agile in understanding the consumer behavior in this dynamic experience economy. The winners are the one adapt the most.

More readings?

>> Read more: Malaysia in 2021: Current trends, growth, and opportunities

>> Read more: Social Commerce: The Rising Trend in Malaysia

>> Read more: Malaysia, Your Next E-Commerce Destinati

About Boxme: Boxme is the premier E-commerce fulfillment network in Southeast Asia, enabling world-wide merchants to sell online into this region without needing to establish a local presence. We deliver our services by aggregating and operating a one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last-mile delivery, local payment collection and oversea remittance.