Vietnam’s logistics market has witnessed drastic growth thanks to the country’s booming GDP, rising manufacturing, and e-commerce sectors. Additionally, the rapid adoption of e-commerce by the country’s young demographic has increased the demand for expansion in logistic services.

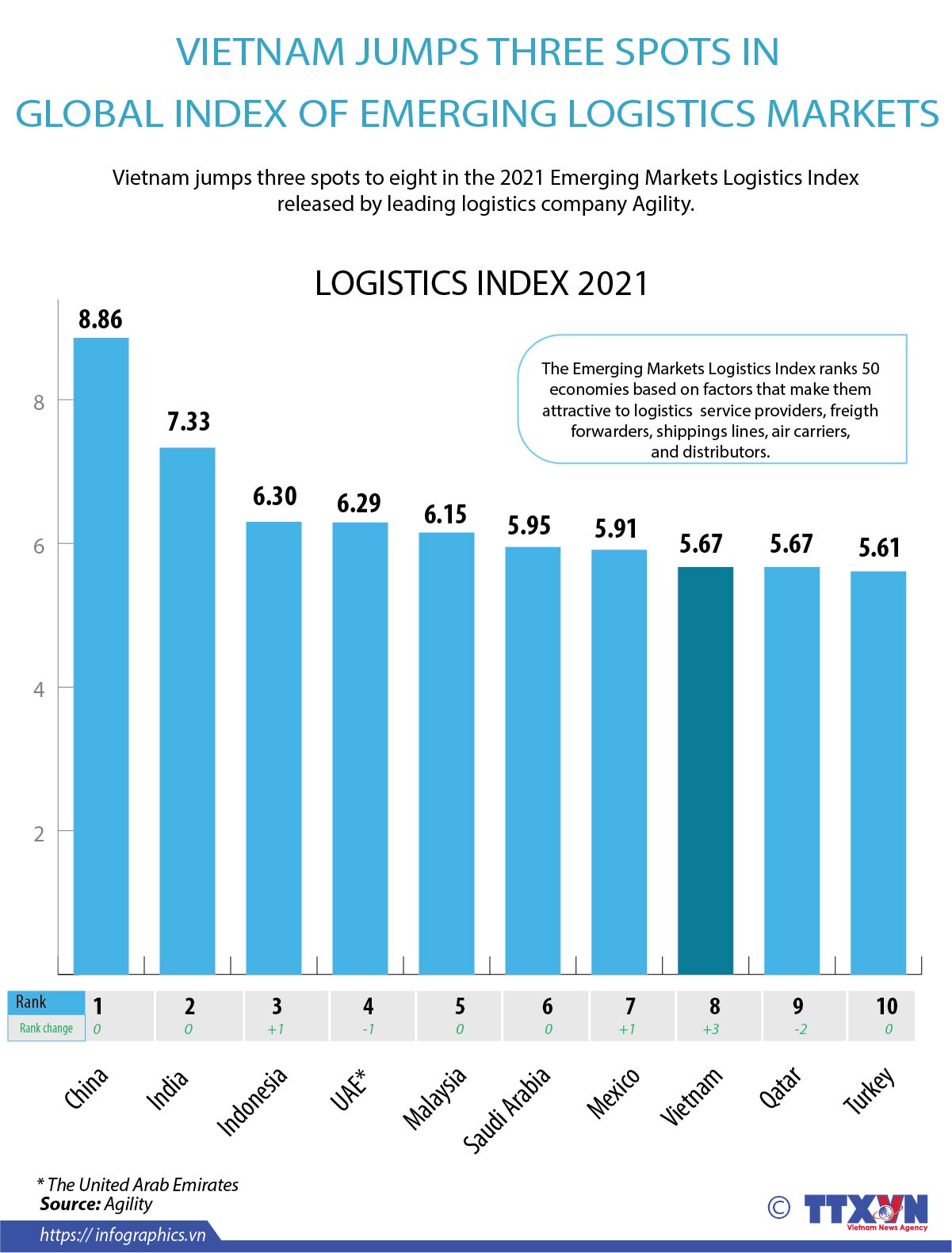

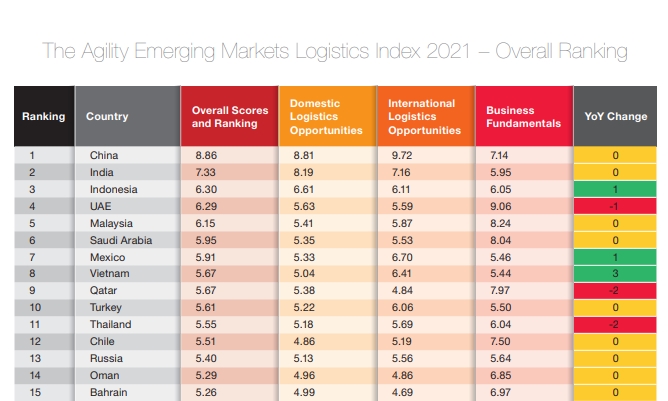

According to the Market Logistics Index report, Vietnam has a striking jump into the 8th position in this year’s global index of emerging logistics markets. The country had an overall score of 5.67 out of 10 in 2021.

Accordingly, China remained the world’s leading emerging logistics market followed by India, while Indonesia ranked in third position. Qatar and Turkey ranked behind Vietnam in 9th and 10th position. Among ASEAN countries, Indonesia ranked third, Malaysia ranked fifth, Vietnam ranked 8th, Thailand ranked 11th, Philippines ranked 21st and Cambodia 41st.

>> Read more: Vietnam rises as a manufacture destination amid US-China trade war

>> Read more: Key factors of E-commerce logistics in Vietnam

Based on the data provided by Vietnam Logistics Business Association’s survey, there are around 30,000 logistics companies in the country, 4,000 of them foreign-owned.

The industry has been growing at 12-14 percent annually and is now worth $40-42 billion.

The eight place of Vietnam in the global logistics markets indicate the successful suppression of the country from the global pandemic Covid 19. Vietnam effectively positioned the market to attract businesses, investors to leave highly-contaminated covid countries such as China and possess an enviable investment pipeline across a number of sectors for example: fashion, electronics, and so on.

>>> Read more: The landscape of eCommerce in Vietnam in 2020

This trend is predicted to further grow to the year 2022.

According to the Vietnam Logistics Business Association‘s latest survey, there are around 30,000 logistics companies in the country, 4,000 of them foreign-owned.

The industry has been growing at 12-14 percent annually and is now worth $40-42 billion.

>> Read more: Vietnam media landscape 2020; 5 changes to notice

>> Read more:The map of Vietnam Ecommerce (statistics from iPrice)

On the other hand, the investment and the arrival of foreign businesses in Vietnam can create some challenges. For instance, Weak transport infrastructure and high logistics cost remain to be market restraints.

Increasing GDP, dominance of the young generation together with the constant adoption of new technologies has posed a greatest chance for Vietnam e-commerce, particularly the logistics market to further grow in upcoming years.

>> Read more: Vietnam eCommerce is heading for the period 2021 – 2025

>> Read more: Vietnam media landscape 2020; 5 changes to notice

It is predicted for the logistics market to have new trends in the year 2021. Let’s find out with Boxme what are these new trends in the next article.

About Boxme: Boxme is the premier E-commerce fulfillment network in Southeast Asia, enabling world-wide merchants to sell online into this region without needing to establish a local presence. We deliver our services by aggregating and operating a one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last-mile delivery, local payment collection and oversea remittance.