The trade war between the US and China won’t loosen up any time soon (Illustration by Eric Chow)

New tariffs urge corporations to flee to Vietnam

At the end of August, the United States began imposing another round of tariffs on a variety of Chinese goods: 15% instead of the existing 10% on footwear, smartwatches and flat-panel televisions. This is the latest escalation in the prolonging trade war between the two biggest economies, urging companies across a wide range of industries to consider shifting production outside of China as a way to cope with higher spending. Southeast Asia countries such as Thailand, Malaysia and especially Vietnam have been main beneficiaries of this trade war spill.

Recently, manufacturers like Nintendo, Sharp, Techtronic and Kyocera all announced plans to move several processes of production from China to Vietnam. Foxconn, a Taiwanese electronics manufacturer, one of Apple’s key suppliers, already acquired a piece of land in Vietnam to establish a factory in the future. Last year, GoerTek – another Apple manufacturer also revealed that the company is moving its production line from Shandong to Vietnam, with trial production launching this July. As for Google, a Nikkei source states that they already started working on converting an old Nokia factory in Vietnam’s Bac Ninh province to produce Pixel smartphones. These movements are a result of corporations finding alternatives to avoid extra tariffs and higher Chinese labor costs.

Workers in a Vietnamese manufacturing firm (Image source: baomoi.com)

Vietnam’s manufacturing potential

This is not the early beginning of Vietnam’s manufacture industry as goods exporting has always been Vietnam’s leading sector. With the country’s top exports being electronics, footwear, clothing and machinery respectively, shifting production of these industries from China to Vietnam will not be too costly and time-consuming. A prime example is South Korean giant tech Samsung, who has been manufacturing in Vietnam for over a decade. In 2018, the line “Made in Vietnam” was stamped on half of Samsung’s smartphones and accessories supply worldwide, bringing in a revenue of $70 billion. Samsung’s presence also led some of its South Korean suppliers and partners to set up shop in Vietnam.

The future is looking bright for Vietnam as free trade agreements (CPTPP, EVFTA, KVFTA, JVFTA) are making this Southeast Asian country more attractive to other countries, even outside the Asia-Pacific region. Since 2016, foreign direct investment has been pouring in, skyrocketed from $15.8 billion to $35.8 billion over the course of 3 years. Vietnam’s GDP in 2018 also experienced an optimistic increase of 7.1% while China’s is only 6.6%, leading up to 7.9% in the first quarter of this year, Japanese Investment Bank Nomura revealed. The US has consistently been Vietnam’s largest export market with a total turnover of $38.6 billion in the first 8 months of 2019, upped by 25.3% compared to last year as one of the fastest-growing sources for American imports.

–> See also: Vietnam in 2019: World’s second-biggest textile exporter?

“China+1”, with 1 being Vietnam

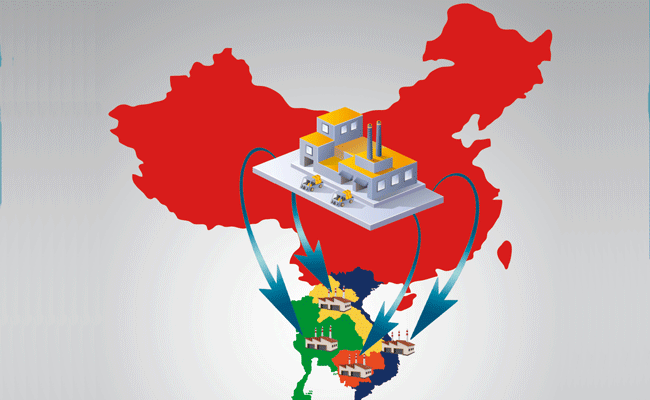

To escape extra tariffs, the “China+1” plan is what some companies have in mind: having Chinese manufacturers produce for domestic use and non-US markets while relocating parts of their production lines to Southeast Asia or elsewhere. Only a small portion of production leaving China goes back to the US, with the rest divided up among countries, forming a new global manufacturing landscape. China still occupies a significant share of the pie, however, this is the chance for developing countries to step up.

The “China+1” strategy (Image source: CKGSB Knowledge)

An opportunity like this is exactly what Vietnam is waiting for. As labor-intensive manufactures like footwear and clothing moved here long ago as a response to rising Chinese wages, now it’s time for the country to expand to electronics and engineering industries – products that are higher up the value chain. The truth is, Vietnamese firms are taking in as many requests as ever. Seditex Co. Ltd., a Ho Chi Minh based company that connects local manufacturers to foreign firms, reports that they are receiving 20 requests per week after the new tariff implementation, instead of the usual 20 per month.

>> You might be interested in: Export potential in Vietnam: PART 1 | PART 2 | PART 3

To fill China’s shoes

Whilst Vietnam seems to be the next country of choice for corporations for diversifying their supply chain facing US tariffs on Chinese-manufactured products, not everyone is convinced. Vietnam can offer cheap labor, but a population of 100 million is still a far cry from China’s 1.3 billion. As global manufacturers rush over to avoid US tariffs, labor shortage is a huge issue. The country might end up with more demand than the capacity they can handle and have to turn potential clients away. Furthermore, Vietnam’s current infrastructures are debatably not up to the task as the majority of companies are small-sized, plus roads and ports are already clogged.

China’s shoes are too large for any country to fill

No country can replace China for the time being, and the creation of new industrial clusters isn’t something that can happen overnight. Most raw materials are produced in China, which means higher costs in procurement and shipping for cross-country manufacture. China built an empire of specialized supply chains with US-focused safety certification and capital-intensive machinery, which aren’t easy to come by anywhere in the world. Other workforces also lack highly specialized skills and training that are already established back in China. The reality check is, there is no ready-made solution for shifting production out of this country.

Other problems

With production barriers on hand, there are additional problems for the Vietnamese government to take care of. Violations like transshipment – a process for Chinese vendors to ship products through Vietnam, and repackaging Chinese goods with “Made in Vietnam” labels are happening, requiring heavier inspections from customs authorities. Having a high trade surplus with the US also put Vietnam in the US’s currency manipulation watchlist, and probably the next target in Trump’s hectic trade war. Last but not least, since most part of the growth in exports goes to foreign direct investment firms, the future might not be that bright for Vietnamese firms.

The era of putting all eggs in one basket is over, the question is, do other baskets fit the eggs?

[vc_separator color=”orange” align=”align_left” style=”dashed”][vc_column_text]

BoxMe is the premier cross-border e-Commerce fulfillment network in South East Asia, enabling world-wide merchants to sell online into this region without needing to establish local presence. We are able to deliver our services by aggregating and operating an one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last mile delivery, local payment collection and oversea remittance.

If you have any question about Boxme Asia or how we can support your business, please contact us directly by referring to our hotline. We are glad to be of service![/vc_column_text]

[vc_raw_js]JTNDJTIxLS1IdWJTcG90JTIwQ2FsbC10by1BY3Rpb24lMjBDb2RlJTIwLS0lM0UlM0NzcGFuJTIwY2xhc3MlM0QlMjJocy1jdGEtd3JhcHBlciUyMiUyMGlkJTNEJTIyaHMtY3RhLXdyYXBwZXItYTkxNTk3YzUtMzU5ZC00ZjcxLTlhMTctMDJiNzUwMWVmYWRjJTIyJTNFJTNDc3BhbiUyMGNsYXNzJTNEJTIyaHMtY3RhLW5vZGUlMjBocy1jdGEtYTkxNTk3YzUtMzU5ZC00ZjcxLTlhMTctMDJiNzUwMWVmYWRjJTIyJTIwaWQlM0QlMjJocy1jdGEtYTkxNTk3YzUtMzU5ZC00ZjcxLTlhMTctMDJiNzUwMWVmYWRjJTIyJTNFJTNDJTIxLS0lNUJpZiUyMGx0ZSUyMElFJTIwOCU1RCUzRSUzQ2RpdiUyMGlkJTNEJTIyaHMtY3RhLWllLWVsZW1lbnQlMjIlM0UlM0MlMkZkaXYlM0UlM0MlMjElNUJlbmRpZiU1RC0tJTNFJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRmN0YS1yZWRpcmVjdC5odWJzcG90LmNvbSUyRmN0YSUyRnJlZGlyZWN0JTJGMjE0MTUyOCUyRmE5MTU5N2M1LTM1OWQtNGY3MS05YTE3LTAyYjc1MDFlZmFkYyUyMiUyMCUzRSUzQ2ltZyUyMGNsYXNzJTNEJTIyaHMtY3RhLWltZyUyMiUyMGlkJTNEJTIyaHMtY3RhLWltZy1hOTE1OTdjNS0zNTlkLTRmNzEtOWExNy0wMmI3NTAxZWZhZGMlMjIlMjBzdHlsZSUzRCUyMmJvcmRlci13aWR0aCUzQTBweCUzQiUyMiUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm8tY2FjaGUuaHVic3BvdC5jb20lMkZjdGElMkZkZWZhdWx0JTJGMjE0MTUyOCUyRmE5MTU5N2M1LTM1OWQtNGY3MS05YTE3LTAyYjc1MDFlZmFkYy5wbmclMjIlMjAlMjBhbHQlM0QlMjJMZXZlcmFnZSUyME91ciUyMFNvbHV0aW9uJTIyJTJGJTNFJTNDJTJGYSUzRSUzQyUyRnNwYW4lM0UlM0NzY3JpcHQlMjBjaGFyc2V0JTNEJTIydXRmLTglMjIlMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRmpzLmhzY3RhLm5ldCUyRmN0YSUyRmN1cnJlbnQuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlM0NzY3JpcHQlMjB0eXBlJTNEJTIydGV4dCUyRmphdmFzY3JpcHQlMjIlM0UlMjBoYnNwdC5jdGEubG9hZCUyODIxNDE1MjglMkMlMjAlMjdhOTE1OTdjNS0zNTlkLTRmNzEtOWExNy0wMmI3NTAxZWZhZGMlMjclMkMlMjAlN0IlN0QlMjklM0IlMjAlM0MlMkZzY3JpcHQlM0UlM0MlMkZzcGFuJTNFJTNDJTIxLS0lMjBlbmQlMjBIdWJTcG90JTIwQ2FsbC10by1BY3Rpb24lMjBDb2RlJTIwLS0lM0U=[/vc_raw_js][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column]