With its rising costs, China is no longer the go-to destination for many businesses, and Vietnam has arisen as a potential competitor. Recent trends show that the number of orders shifting from China to Vietnam has seen a significant increase.

For example, China’s Pearl River Delta, long known as one of the key factory centers for the world’s manufacturers (particularly those from Hong Kong) has now become too costly for many companies to stay in the region.

(Source: BusinessSweden)

In the past three years alone, a growing number of businesses have relocated their operations from China to Vietnam in an attempt to escape rising costs and an increasingly complex regulatory environment.

Located in a strategic position for foreign companies with operations throughout Southeast Asia, Vietnam is an ideal export hub to reach other ASEAN markets.

->> [Southeast Asia] Export Potential in Vietnam (PART I)

Here in the second edition of the Southeast Asia analyzing series, we take a look at Vietnam and why you should consider this vibrant market for e-Commerce exports and sourcing products.

Opportunities for businesses in Vietnam

Textiles – Garments & Coffee

Textiles and Garments

Textiles consistently rank among Vietnam’s leading export industries, employing up to 1.3 million workers in directly related jobs and more than two million with auxiliary work included.

The growth of the garment industry has been nothing short of impressive. The Vietnam Textile and Apparel Association states that Vietnamese garment exports rose by 14.9 percent in July 2018 alone. China is the only nation that surpasses Vietnam in terms of net garment exports to the U.S.

That said, manufacturers and investors are pivoting towards Vietnam – the conditions for setting up shop are economical and more convenient than doing so in China.

(Source: VOVOnlineNewspaper)

In fact, within ASEAN, Vietnam is the strongest competitor for inheriting low value-added textiles and apparel manufacturing from China.

In contrast to other leading textile exporters in the Southeast Asia region (Indonesia, Thailand, Malaysia), the share of Vietnam’s textile exports against its total exports has grown in recent years.

In terms of revenue, footwear is Vietnam’s second most productive export industry, generating USD 19.9 billion in 2017. The country produces approximately 800 million pairs of shoes per year.

Truth is, Vietnam is currently the fourth largest producer of footwear in the world. Only China, India and Brazil make more!

Coffee

(Source: Coffeemakered)

Vietnam is poised to become the world’s largest producer and exporter of coffee.

Currently, the country is the world’s second largest coffee exporter, behind only Brazil. However, many experts believe that Vietnam has the potential to even overtake Brazil, thanks to such factors as favorable climate conditions and lower cost production.

In recent years, coffee has become one of Vietnam’s key agricultural export products – with 95 percent of output being shipped abroad.

Energy

Power

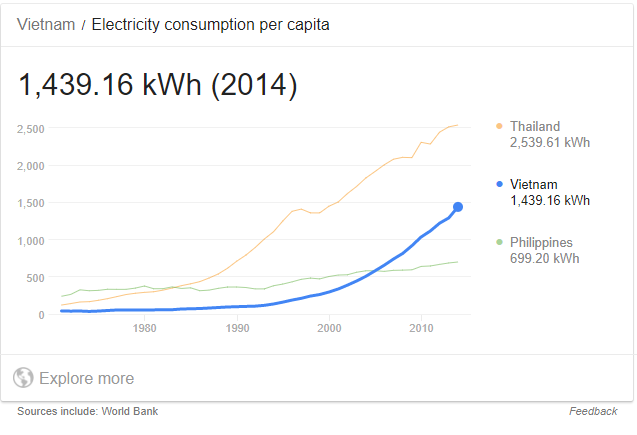

Power consumption in Vietnam has increased almost 5 fold between 2000 and 2014. Estimated growth is forecast to be 12% to 15% in the 2020 to 2030 period. Vietnam forecasts that nuclear power plants will supply 20% to 25% of its power supply by 2050.

Vietnam’s power development plan includes:

- About USD 130 billion investment in the next 20 years

- 65.5% of investment to develop power generation

- Building nuclear power plants on 7 sites

- Building 183 new power plants by 2025, of which 90 will be coal based plants

There are opportunities for regional companies in all project phases, including consultancy and equipment.

Opportunities for companies in specialist power areas include:

- Education and training

- Regulation and safety management

- Security

- Waste management

- Operation management

Oil and gas

(Source: WorldFinance)

Vietnam is Southeast Asia’s sixth largest oil producer. Opportunities for companies include supply of equipment and services for:

- Seismic surveying for oil and gas exploration

- Engineering, construction and production facilities

- Drilling and production technologies, including drilling rigs (70 to 200 metres)

- Oil spill management

- Refineries

- Health, safety and environmental waste management

- Consultancy

- Training and education

Electronics

Vietnam has emerged as an important electronics exporter, with electrical and electronic products gradually overtaking coffee, textiles, and rice to become the country’s top export item.

Samsung is Vietnam’s largest exporter and has helped the country achieve a trade surplus for the first time in many years. Exports of smartphones and computer parts now account for more in export earnings than oil and garments.

Samsung is attempting to turn Vietnam into a global manufacturing base for its products and has invested over US$10 billion into the country.

(Source: vovworld)

In addition to that, the company has also agreed to cooperate with the Vietnamese government in order to help develop the country’s domestic support industries.

This represents a key business opportunity for foreign technology companies to set up operations in Vietnam and sell their components to companies like Samsung.

On July 29, 2014, Intel announced that it had produced its first made-in-Vietnam CPU. By the end of that year, Intel successfully manufactured 70 percent of their CPUs for the world market in Vietnam.

Education and training

There are a number of foreign education institutions doing business in Vietnam. However, there is room for many more due to the size of the market.

Vietnam has:

- A relatively young population

- Increase recognition of the importance of education in the family

- Need for better vocational training

The Vietnamese Prime Minister signed decision 404/QĐ-TTg in March 2015 to approve a curriculum project worth USD 37 million. The Ministry of Education and Training plan to launch the curriculum and textbooks in 2019-2020 academic year.

(Source: ThePIENews)

The Ministry of Education and Training have spent more than USD 10 million on equipment for a pilot smart school project in the last 2 years. A further USD 89 million will be spent in the next 3 years.

Opportunity areas in Vietnam include:

- Curriculum reform

- Teacher training

- English language training

- Vocational and technical education

- Higher education collaboration

- School equipment

Healthcare and pharmaceuticals

Vietnam’s health care system is a mixed public-private system. However, the healthcare system has been slow to develop.

Around 30,000 Vietnamese people travel abroad annually to seek treatment in foreign hospitals.

The government has offered incentives to healthcare investors including:

- Lower corporate income tax rate

- 4 year tax exemption

- Land rent reduction/exemption for at least 7 years

Vietnamese pharmaceutical production and supply capacity is weak. It spends more than USD 1 billion every year on imported drugs.

(Source: dantri)

Joint ventures with local companies should be considered as well as direct exports to access opportunities in Vietnam.

Most hospital medical equipment is imported as most domestic health equipment in Vietnam has yet to meet national and international quality standards.

Local production accounts for only 5% of the market. Therefore, there is potential for medical equipment companies in the region to export to Vietnam.

Mass transport

The government will increase investment in transport infrastructure from USD 7 billion to USD 120 billion by 2020. Infrastructure plans include:

- Building 2 new international standard airports

- Upgrading 7 existing airports

- Building 6 metro operations in Hanoi and Ho Chi Minh City

(Source: WashingtonTimes)

Regional companies will have the opportunity to offer:

- Consulting

- Technology

- Design/construction

- Project management

Working in partnership with leading contractors from Japan and South Korea is also an option.

There is potential for companies to become involved in the operation of the airline industry in Vietnam.

Start-up considerations

Regional companies can approach the Vietnamese market in several ways:

- Export directly

- Set up an agency

- Appoint a distributor

- Open a representative office

- Open a branch

- Form a joint venture

- Set up a 100% foreign owned company

- Enter via a business cooperation contract

- Enter via a Build-Operate-Transfer (BOT) type contract

- Franchise/licensing

You should have a local representative acting as an importer/distributor for direct exports. In some certain cases, pre-registration of exporters/producers is required.

Getting information in Vietnam can be difficult so it’s important to develop personal relationships. Seeking legal advice if you intend to set up a company or do business in Vietnam

->> Tramping down import/export barriers for a smooth business expansion.

TO BE CONTINUED…

[vc_separator color=”orange” align=”align_left” style=”dashed”][vc_column_text]BoxMe is the premier cross-border e-Commerce fulfillment network in South East Asia, enabling world-wide merchants to sell online into this region without needing to establish local presence. We are able to deliver our services by aggregating and operating an one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last mile delivery, local payment collection and oversea remittance.

If you have any question about Boxme Asia or how we can support your business, please contact us directly by referring to our hotline. We are glad to be of service![/vc_column_text]

[vc_raw_js]JTNDJTIxLS1IdWJTcG90JTIwQ2FsbC10by1BY3Rpb24lMjBDb2RlJTIwLS0lM0UlM0NzcGFuJTIwY2xhc3MlM0QlMjJocy1jdGEtd3JhcHBlciUyMiUyMGlkJTNEJTIyaHMtY3RhLXdyYXBwZXItYTkxNTk3YzUtMzU5ZC00ZjcxLTlhMTctMDJiNzUwMWVmYWRjJTIyJTNFJTNDc3BhbiUyMGNsYXNzJTNEJTIyaHMtY3RhLW5vZGUlMjBocy1jdGEtYTkxNTk3YzUtMzU5ZC00ZjcxLTlhMTctMDJiNzUwMWVmYWRjJTIyJTIwaWQlM0QlMjJocy1jdGEtYTkxNTk3YzUtMzU5ZC00ZjcxLTlhMTctMDJiNzUwMWVmYWRjJTIyJTNFJTNDJTIxLS0lNUJpZiUyMGx0ZSUyMElFJTIwOCU1RCUzRSUzQ2RpdiUyMGlkJTNEJTIyaHMtY3RhLWllLWVsZW1lbnQlMjIlM0UlM0MlMkZkaXYlM0UlM0MlMjElNUJlbmRpZiU1RC0tJTNFJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRmN0YS1yZWRpcmVjdC5odWJzcG90LmNvbSUyRmN0YSUyRnJlZGlyZWN0JTJGMjE0MTUyOCUyRmE5MTU5N2M1LTM1OWQtNGY3MS05YTE3LTAyYjc1MDFlZmFkYyUyMiUyMCUzRSUzQ2ltZyUyMGNsYXNzJTNEJTIyaHMtY3RhLWltZyUyMiUyMGlkJTNEJTIyaHMtY3RhLWltZy1hOTE1OTdjNS0zNTlkLTRmNzEtOWExNy0wMmI3NTAxZWZhZGMlMjIlMjBzdHlsZSUzRCUyMmJvcmRlci13aWR0aCUzQTBweCUzQiUyMiUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm8tY2FjaGUuaHVic3BvdC5jb20lMkZjdGElMkZkZWZhdWx0JTJGMjE0MTUyOCUyRmE5MTU5N2M1LTM1OWQtNGY3MS05YTE3LTAyYjc1MDFlZmFkYy5wbmclMjIlMjAlMjBhbHQlM0QlMjJMZXZlcmFnZSUyME91ciUyMFNvbHV0aW9uJTIyJTJGJTNFJTNDJTJGYSUzRSUzQyUyRnNwYW4lM0UlM0NzY3JpcHQlMjBjaGFyc2V0JTNEJTIydXRmLTglMjIlMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRmpzLmhzY3RhLm5ldCUyRmN0YSUyRmN1cnJlbnQuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlM0NzY3JpcHQlMjB0eXBlJTNEJTIydGV4dCUyRmphdmFzY3JpcHQlMjIlM0UlMjBoYnNwdC5jdGEubG9hZCUyODIxNDE1MjglMkMlMjAlMjdhOTE1OTdjNS0zNTlkLTRmNzEtOWExNy0wMmI3NTAxZWZhZGMlMjclMkMlMjAlN0IlN0QlMjklM0IlMjAlM0MlMkZzY3JpcHQlM0UlM0MlMkZzcGFuJTNFJTNDJTIxLS0lMjBlbmQlMjBIdWJTcG90JTIwQ2FsbC10by1BY3Rpb24lMjBDb2RlJTIwLS0lM0U=[/vc_raw_js][vc_row][vc_column][vc_column_text][/vc_column_text][/vc_column]