[vc_row][vc_column][vc_column_text]e-Commerce in Asia and the Pacific as a whole is booming. It is already the world’s largest retail e-commerce market with the bulk of sales (47 percent) coming from China, but total sales are expected to almost triple from $1 trillion in 2016 to $2.7 trillion in 2020. The main factors behind this are an expanding middle class, rapidly increasing mobile utility and Internet penetration, growing competition among sellers, and improving logistics and infrastructure.

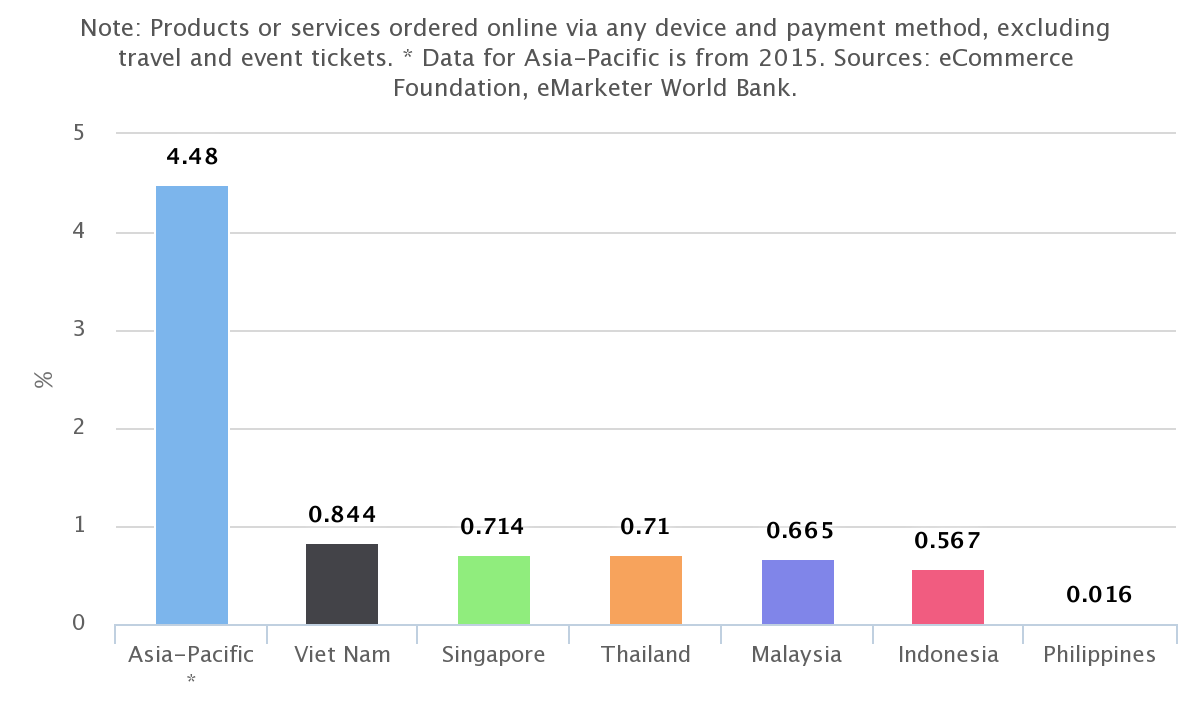

However, recent ADB research shows that Southeast Asia, to much surprise, is lagging far behind the rest of the region. In Southeast Asia, the e-Commerce market is still at a dawning stage, due particularly to underdeveloped digital payment methods and a weak logistics framework.

The number of companies in Southeast Asia having their own websites and use email to communicate with clients – a vital element of B2C (business-to-consumer) interactions, which comprise almost 50 percent of e-Commerce turnover – are both well below the regional average.

But thanks largely to social media, this will soon change, hopefully for the better.

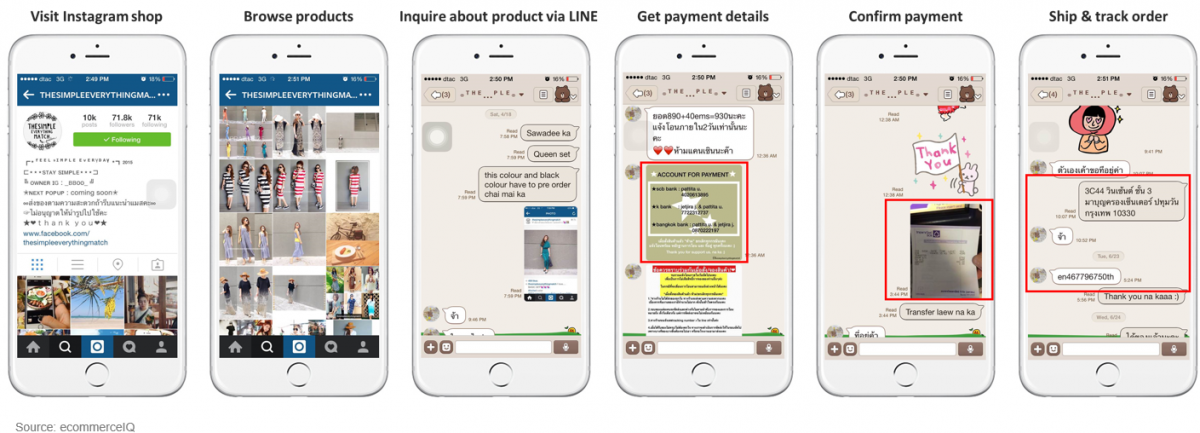

Social commerce – sales driven by social media – is a potential game-changer for e-Commerce in Southeast Asia. It accounted for 30 percent of all online sales in the region in 2016 and will likely increase its share in the years to come.

Social media platforms offer greater accessibility & flexibility, more dynamic elements, and cost-efficient benefits compared to traditional email blasts and online stores. These benefits are particularly vital for SMEs and users with limited resources and insightful expertise to maintain websites.

(Source: ecommerceIQ)

In Thailand, the world’s biggest social commerce market, 51 percent of online shoppers have reportedly purchased goods directly via a social media channel. In Malaysia and Indonesia, every third online shopper connects to a social media network to purchase goods.

Social Media Users Going Mobile

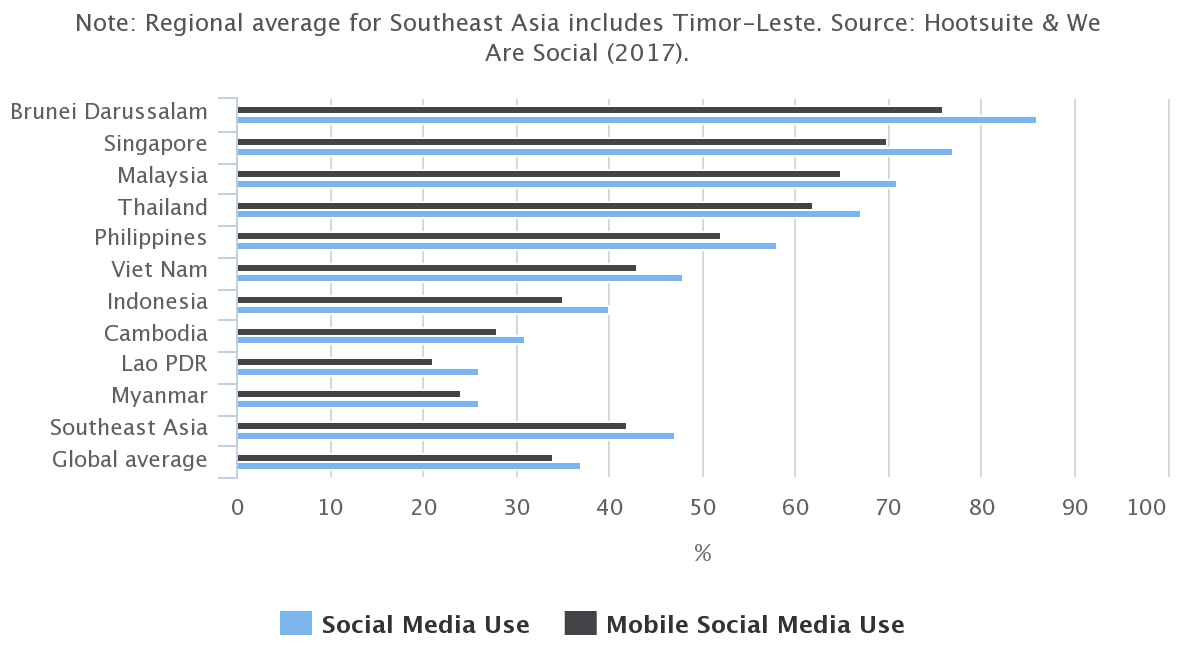

It is Southeast Asia’s relatively young population and improved access to the Internet on mobile devices that propels the growth of social commerce. According to a 2017 study by Hootsuite and We Are Social, approximately 47 percent (306 million) of people in Southeast Asia are active social media users. 42 percent of the population (273 million) accesses social media networks via mobile devices.

Seven Southeast Asian countries currently have social media penetration rates higher than the global average of 37 percent: Brunei, Singapore, Malaysia, Thailand, the Philippines, Vietnam and Indonesia. In addition, there’s also a blooming in the number of active social media users in these countries between January 2016 and January 2017 of above 20 percent.

Seven Southeast Asian countries currently have social media penetration rates higher than the global average of 37 percent: Brunei, Singapore, Malaysia, Thailand, the Philippines, Vietnam and Indonesia. In addition, there’s also a blooming in the number of active social media users in these countries between January 2016 and January 2017 of above 20 percent.

Indonesia (39 percent), the Philippines (32 percent), and Vietnam (41 percent) are ranked among the top ten countries with the highest growth of mobile social media users during this span.

So could social media actually be the future of online retail in the region? Facebook and Instagram, for instance, could and has already become the preferred platform for most SMEs. Pinterest and Twitter are also emerging niche playgrounds, despite their relatively smaller user base.

Creating an Environment Favorable to Growth

For social commerce to be successful in the future, it is essential to develop the necessary market infrastructure and legal frameworks to facilitate transactions. One solution to unlock the region’s e-commerce potential could be messaging apps. By engaging customers directly online and making business communications more private, these apps could help build consumer trust in the online transaction process and partly address the lack of security and confidence that haunts online payments and delivery.

Low levels of financial account ownership and credit/debit card penetration in Southeast Asian economies to date remain a huge challenge. Currently, e-commerce continues to be largely a domestic story. Ultimately, for social media to encourage more cross-border e-commerce, Southeast Asia must significantly expand consumer access to advanced payment systems that operate in several countries and develop a robust shipping & fulfillment network.

Finally, SMEs and local startups could be the prime beneficiary of social commerce through reduced costs and improved market access both domestically and across borders. Below are some key recommendations for Southeast Asian countries eager to capitalize on social media for e-Commerce:

- Boost market accessibility by removing barriers to digital trade

- Introduce legal, regulatory and institutional reforms to accommodate electronic business, facilitate access and connectivity, and enable e-payments

- Foster an enabling environment for digital businesses through investment, especially in local startup networks/ecosystems

- Improve the availability and quality of connectivity infrastructure

[vc_separator color=”orange” align=”align_left” style=”dashed”][vc_column_text]BoxMe is the premier cross-border e-Commerce fulfillment network in South East Asia, enabling world-wide merchants to sell online into this region without needing to establish local presence. We are able to deliver our services by aggregating and operating an one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last mile delivery, local payment collection and oversea remittance.

If you have any question about Boxme Asia or how we can support your business, please contact us directly by referring to our hotline. We are glad to be of service![/vc_column_text][/vc_column][/vc_row][vc_column][/vc_column][vc_row][vc_column][vc_raw_js]JTNDJTIxLS1IdWJTcG90JTIwQ2FsbC10by1BY3Rpb24lMjBDb2RlJTIwLS0lM0UlM0NzcGFuJTIwY2xhc3MlM0QlMjJocy1jdGEtd3JhcHBlciUyMiUyMGlkJTNEJTIyaHMtY3RhLXdyYXBwZXItYWI5ZjU3MjEtZjZkNC00YzhmLTk5YWUtOGMxNWFlZGNlZmEwJTIyJTNFJTNDc3BhbiUyMGNsYXNzJTNEJTIyaHMtY3RhLW5vZGUlMjBocy1jdGEtYWI5ZjU3MjEtZjZkNC00YzhmLTk5YWUtOGMxNWFlZGNlZmEwJTIyJTIwaWQlM0QlMjJocy1jdGEtYWI5ZjU3MjEtZjZkNC00YzhmLTk5YWUtOGMxNWFlZGNlZmEwJTIyJTNFJTNDJTIxLS0lNUJpZiUyMGx0ZSUyMElFJTIwOCU1RCUzRSUzQ2RpdiUyMGlkJTNEJTIyaHMtY3RhLWllLWVsZW1lbnQlMjIlM0UlM0MlMkZkaXYlM0UlM0MlMjElNUJlbmRpZiU1RC0tJTNFJTNDYSUyMGhyZWYlM0QlMjJodHRwcyUzQSUyRiUyRmN0YS1yZWRpcmVjdC5odWJzcG90LmNvbSUyRmN0YSUyRnJlZGlyZWN0JTJGMjE0MTUyOCUyRmFiOWY1NzIxLWY2ZDQtNGM4Zi05OWFlLThjMTVhZWRjZWZhMCUyMiUyMCUzRSUzQ2ltZyUyMGNsYXNzJTNEJTIyaHMtY3RhLWltZyUyMiUyMGlkJTNEJTIyaHMtY3RhLWltZy1hYjlmNTcyMS1mNmQ0LTRjOGYtOTlhZS04YzE1YWVkY2VmYTAlMjIlMjBzdHlsZSUzRCUyMmJvcmRlci13aWR0aCUzQTBweCUzQiUyMiUyMHNyYyUzRCUyMmh0dHBzJTNBJTJGJTJGbm8tY2FjaGUuaHVic3BvdC5jb20lMkZjdGElMkZkZWZhdWx0JTJGMjE0MTUyOCUyRmFiOWY1NzIxLWY2ZDQtNGM4Zi05OWFlLThjMTVhZWRjZWZhMC5wbmclMjIlMjAlMjBhbHQlM0QlMjJMZWFybiUyME1vcmUlMjBBYm91dCUyME91ciUyMFNvbHV0aW9uJTIyJTJGJTNFJTNDJTJGYSUzRSUzQyUyRnNwYW4lM0UlM0NzY3JpcHQlMjBjaGFyc2V0JTNEJTIydXRmLTglMjIlMjBzcmMlM0QlMjJodHRwcyUzQSUyRiUyRmpzLmhzY3RhLm5ldCUyRmN0YSUyRmN1cnJlbnQuanMlMjIlM0UlM0MlMkZzY3JpcHQlM0UlM0NzY3JpcHQlMjB0eXBlJTNEJTIydGV4dCUyRmphdmFzY3JpcHQlMjIlM0UlMjBoYnNwdC5jdGEubG9hZCUyODIxNDE1MjglMkMlMjAlMjdhYjlmNTcyMS1mNmQ0LTRjOGYtOTlhZS04YzE1YWVkY2VmYTAlMjclMkMlMjAlN0IlN0QlMjklM0IlMjAlM0MlMkZzY3JpcHQlM0UlM0MlMkZzcGFuJTNFJTNDJTIxLS0lMjBlbmQlMjBIdWJTcG90JTIwQ2FsbC10by1BY3Rpb24lMjBDb2RlJTIwLS0lM0U=[/vc_raw_js][/vc_column][/vc_row]