Thailand e-commerce market has seen a steady growth in recent years thanks to its huge potential. It is expected to expand over 20 percent annually in upcoming years, considered as the second largest digital economy in the Southeast Asia.

Large room for growth

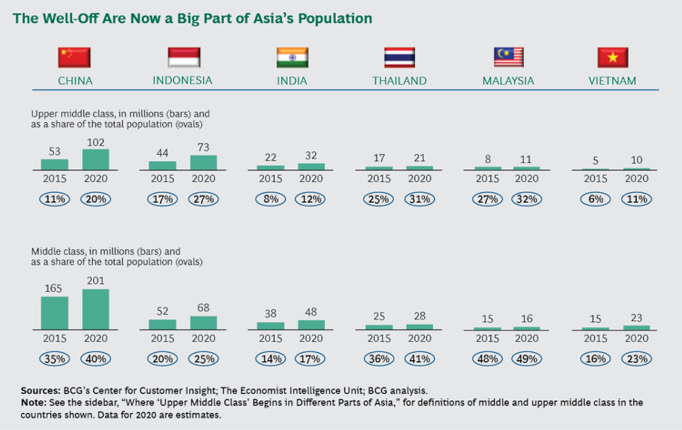

Thailand is the second largest economy in Southeast Asia with the GPD of $406.8bn in 2016, after Indonesia. Thailand has been an upper-middle income economy since 2011. The country has seen a rise in GDP per capia in recent years, at 5.907,91 USD in 2016. Not surprisingly, a quarter of the population is upper middle class and over one third is middle class in the total population of 68.22 million people. These categories are not only about social status but also consuming power. Moreover, the numbers are projected to increase in the upcoming years.

Thailand is the second largest economy in Southeast Asia with the GPD of $406.8bn in 2016, after Indonesia. Thailand has been an upper-middle income economy since 2011. The country has seen a rise in GDP per capia in recent years, at 5.907,91 USD in 2016. Not surprisingly, a quarter of the population is upper middle class and over one third is middle class in the total population of 68.22 million people. These categories are not only about social status but also consuming power. Moreover, the numbers are projected to increase in the upcoming years.

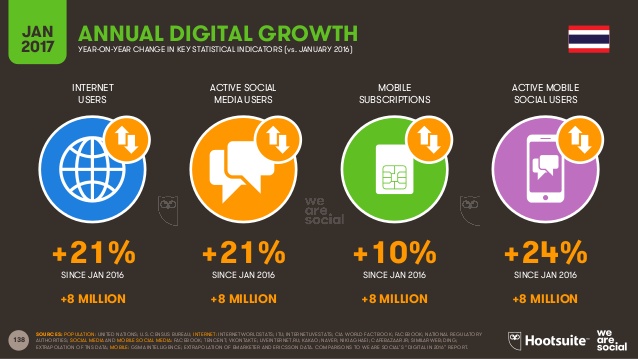

The latest report from We Are Social showed that 67 percent of Thailand population, equivalent to 46 million people, have access to Internet as of January 2017. It is a significant rise of 21 percent compared to January 2016. The Electronic Transactions Development Agency reported that Thais spent in average 6.4 hours a day on the Internet in 2016. According to Statista, 21.7 percent Thailand internet users are forecasted to be online shoppers in 2017, and the number is expected to reach 24.5 percent in 2021. A recent survey by Manhattan Associates revealed that about 40% of online shoppers in Thailand are millennials, who were born between the 1980s and the early 2000s.

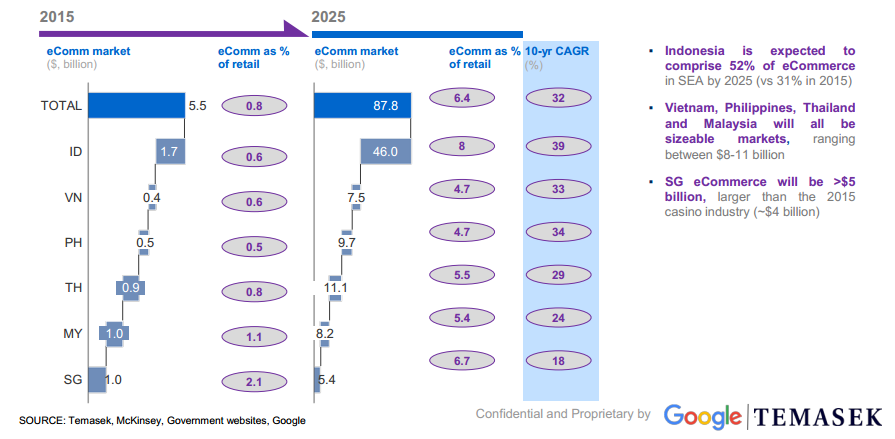

The e-commerce era in Thailand has just begun. The recent report by Google and Temasek showed that e-commerce market in Thailand values US $0.9 billion, accounting for just 0.8 percent of total retail in 2015. It is projected to rocket 29 percent to reach US $11.1 billion by 2025. No doubt, e-commerce in Thailand has a large room for growth in the upcoming time.

The e-commerce era in Thailand has just begun. The recent report by Google and Temasek showed that e-commerce market in Thailand values US $0.9 billion, accounting for just 0.8 percent of total retail in 2015. It is projected to rocket 29 percent to reach US $11.1 billion by 2025. No doubt, e-commerce in Thailand has a large room for growth in the upcoming time.

Intense competition

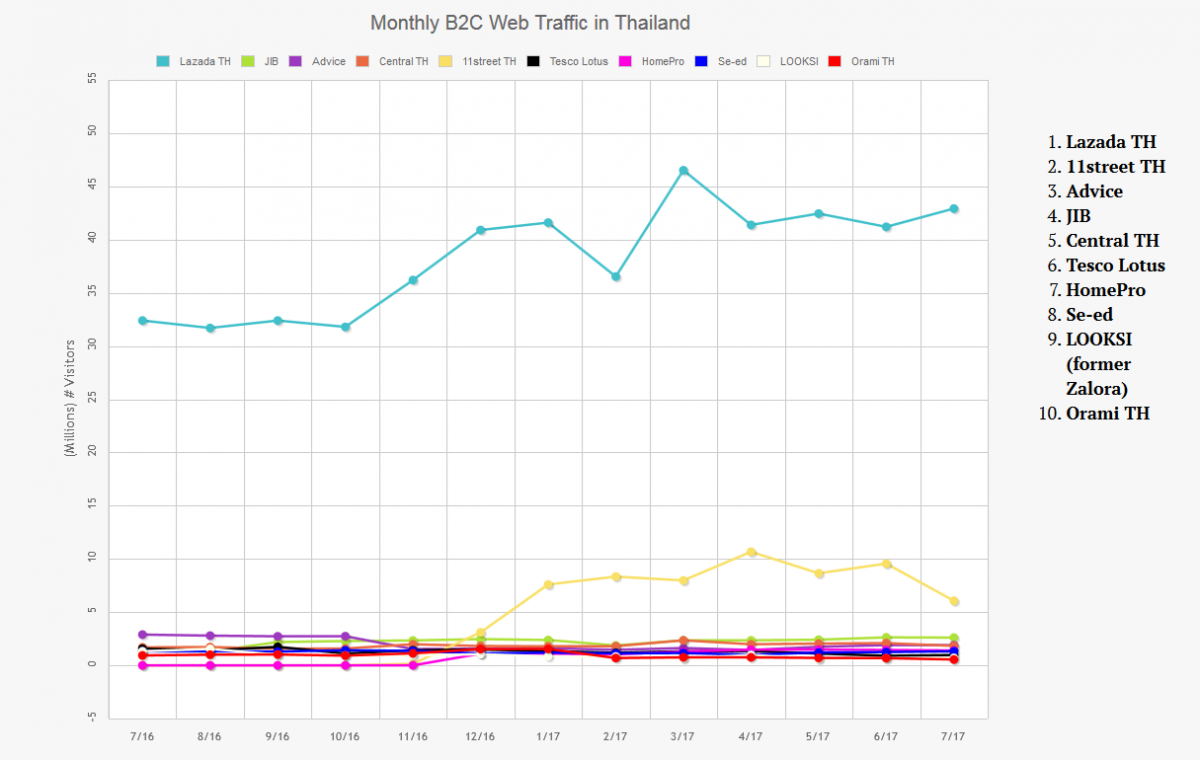

Thailand is the second largest B2C e-commerce market in Southeast Asia in terms of sales, according to Thailand B2C E-Commerce Market 2017 report by yStats.com. Like Vietnam digital market, Thailand local e-commerce players are struggling to compete with foreign rivals. E-commerce market in Thailand has witnessed the dominance of Lazada, which is now even stronger after the acquisition of Chinese internet giant Alibaba. It is easy to see the top position of Lazada in Thailand B2C marketplace. Actually, Lazada monthly traffic outstripped its 4 closest contenders combined, including 11street, Advice, JIB and Central TH. Despite the formidable foothold of Lazada, Thailand e-commerce market is still a gold rust for other players to grab niches. The fast development of B2C Korean ecommerce marketplace 11street since its official launch in Thailand in July 2016 is becoming a challenge to the Rocket Internet’s platform Lazada.

Source: ecommerceiq

Source: ecommerceiq

Thai conglomerates, of course, can’t stand outside of the competition to gain their online market share along with their offline stores. The country e-retail playground observed the join of Central Group with Central.co.th, Tops and Robinson; Thai CP Group with Tesco Lotus, Shopat24 and 24Catalog; BJC Group with C-mart, BigC, AsiaBooks; just to name a few.

Along with B2C ecommerce, C2C model remains an important part of digital market in Thailand. Notably, biggest B2C online platforms in Thailand including Weloveshopping, Tarad, Pramool, Blisby all belong to local players. Grasping the trend of soaring mobile and smartphone usage across the country, most of Thai C2C players also develop their own mobile commerce apps and gain fruits like Weloveshopping, Blisby, and PantipMarket.

Besides, the improvement of Internet broadband and realisation of 4G service in Thailand are drawing a bright picture for e-commerce expansion to not only urban but also rural areas in the country. Singapore-based C2C platform Shopee has seen a significant growth in Thailand since its launch in December 2015. As of March 2017, Shopee gained over 5 million app downloads, one-fifth of the total number in 7 markets it serves including Singapore, Malaysia, Indonesia, Thailand, Vietnam, the Philippines and Taiwan. Garena Online Thailand, the parent company of Shopee Thailand, also reported a strong double-digit monthly growth in 2016 and expects to remain the rate in 2017.

Besides, the improvement of Internet broadband and realisation of 4G service in Thailand are drawing a bright picture for e-commerce expansion to not only urban but also rural areas in the country. Singapore-based C2C platform Shopee has seen a significant growth in Thailand since its launch in December 2015. As of March 2017, Shopee gained over 5 million app downloads, one-fifth of the total number in 7 markets it serves including Singapore, Malaysia, Indonesia, Thailand, Vietnam, the Philippines and Taiwan. Garena Online Thailand, the parent company of Shopee Thailand, also reported a strong double-digit monthly growth in 2016 and expects to remain the rate in 2017.

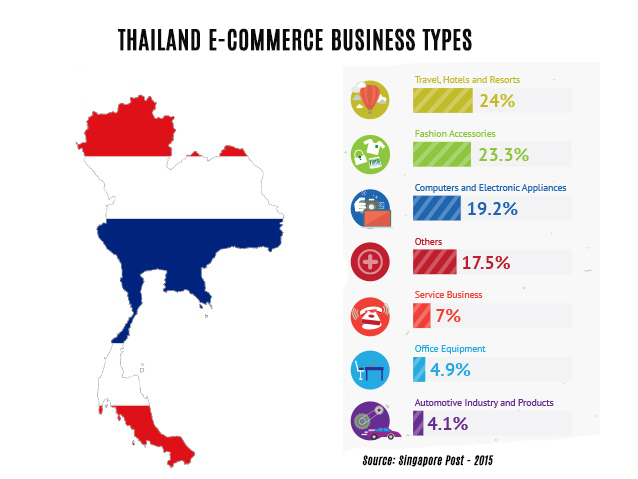

Let’s have a look at e-commerce businesses types in Thailand market:

A shift toward m-commerce and social commerce

A recent survey by Thailand National Statistical Office showed that 90.4 percent of internet users in the country access the Internet via smartphone. Thailand is projected to double the number of smartphone subscriptions from 40 million in 2015 to nearly 80 million by 2021, as stated by Ericsson Mobility Report. Although the country has seen a difference in mobile penetration between urban and rural areas, the urbanisation is bridging this gap.

According to Digital in 2017 Report published by We Are Social and Hootsuite, there are 46 million social media users in Thailand, assuming that all Thailand online population use social networks. The development of social media in Siam creates favourable conditions for the boom of social commerce in the country.

According to Digital in 2017 Report published by We Are Social and Hootsuite, there are 46 million social media users in Thailand, assuming that all Thailand online population use social networks. The development of social media in Siam creates favourable conditions for the boom of social commerce in the country.

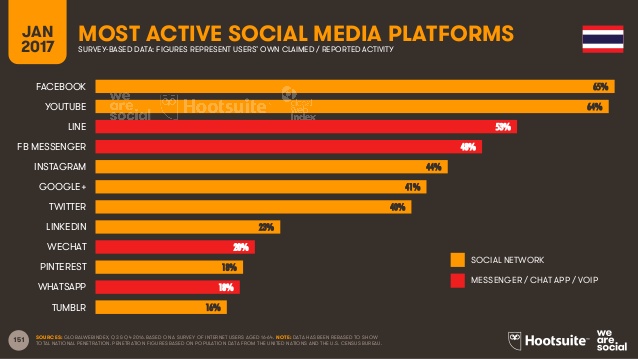

Thailand ranks nine out of top countries with the highest amount of Facebook users, with 47 million accounts. Interestingly, the capital city of Bangkok is home to 30 million Facebook users, which makes it the Facebook most active city in the world. At the end of 2015, Thailand had 33 million LINE users, just after Japan in term of number. As of November 2016, there are 9.1 million Instagram users in Thailand, an increase of 3.2 million, according to NapoleonCat. Do these impressive numbers make sense? No doubt, Thai people love using social platforms as a daily activity. Moreover, they prefer to purchase something via social media rather than e-commerce sites. A recent report on Global Total Retail 2016 by PwC Thailand revealed that 51 per cent of online shoppers in Thailand said they purchased goods directly via a social-media channel. It is estimated that one-third to half of total e-commerce gross merchandise value comes from social platforms like Facebook, LINE, and Instagram.

Thailand ranks nine out of top countries with the highest amount of Facebook users, with 47 million accounts. Interestingly, the capital city of Bangkok is home to 30 million Facebook users, which makes it the Facebook most active city in the world. At the end of 2015, Thailand had 33 million LINE users, just after Japan in term of number. As of November 2016, there are 9.1 million Instagram users in Thailand, an increase of 3.2 million, according to NapoleonCat. Do these impressive numbers make sense? No doubt, Thai people love using social platforms as a daily activity. Moreover, they prefer to purchase something via social media rather than e-commerce sites. A recent report on Global Total Retail 2016 by PwC Thailand revealed that 51 per cent of online shoppers in Thailand said they purchased goods directly via a social-media channel. It is estimated that one-third to half of total e-commerce gross merchandise value comes from social platforms like Facebook, LINE, and Instagram.

A rise in e-payment

Like other emerging e-commerce markets in Southeast Asia, cash on delivery is still the most preferred payment method in Thailand. It is resulted from the lack of trust in online payment and low bank account penetration. According to data from aCommerce, over 70 percent of e-commerce transactions in Thailand chose cash on delivery as payment method.

Despite the dominance of cash payment, there is a sharp increase of using e-wallets in Thailand (for instance: AIS mPAY, TrueMoney, PaysBuy, Rabbit Line Pay, Air Pay, Digio, Alipay, WeChat Pay) as an alternative payment method. Mobile wallets enable both banked and unbanked people to transfer money and pay online in a more easy and sercured way.

According to Thailand central bank statistics, as of September 2016, there were 14.1 million internet banking users and 19.4 million mobile banking users in the country. The number is expected to surge in the coming time as a matter of fact. It is worth noting that Thailand is the pioneer in the Southeast Asia to launch national e-payment system called PromptPay in early 2017. PromptPay is a breakthrough in the development of not only financial system but also e-commerce ecosystem in Thailand. It is expected to boost digital payment for not only retail customers but also B2B activities in Thailand as well as cross-border trade.

According to Thailand central bank statistics, as of September 2016, there were 14.1 million internet banking users and 19.4 million mobile banking users in the country. The number is expected to surge in the coming time as a matter of fact. It is worth noting that Thailand is the pioneer in the Southeast Asia to launch national e-payment system called PromptPay in early 2017. PromptPay is a breakthrough in the development of not only financial system but also e-commerce ecosystem in Thailand. It is expected to boost digital payment for not only retail customers but also B2B activities in Thailand as well as cross-border trade.

Improving logistics

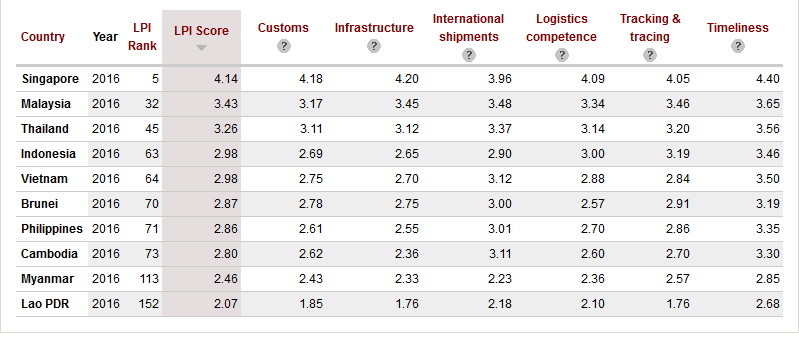

Logistics is the backbone of domestic and international trade of any economy in general and e-commerce in particular. Compared to other Southeast Asia neigbours, Thailand is a strong player when it comes to logistics industry. High logistics cost is an obstacle to the development of digital economy, but it is not a headache problem in Thailand. The government commits to lower the country logistics costs from 14 to 12 percent of GDP by 2021 by upgrading nationwide infrastructure to increase Thailand competitive advantages and leverage economic growth.

Source: World Bank

Source: World Bank

Thailand has attracted numerous logistics service providers in recent years as it is expected to be the e-commerce and logistics powerhouse in the region. Delivery services in Thailand have been improved significantly thanks to enhanced logistics infrastructure as well as fierce competition among service providers. Thai consumers and merchants benefit from the joins of more and more logistics players, from international reputed names to local newly-born startups. The successes of on-demand delivery services like Grabbike, Rush Bike, LalaMove, SendIt are the most trusted proofs for unfilled logistics demand of Thai consumers.

Last mile delivery play field is even more interesting with the competition amongst experienced local firms like Thailand Post; and reputed names in the world such as DHL, Kerry Express, CJ Korea Express, just to name a few. It should be noted that DHL e-commerce expanded operations to Thailand as the first market in Southeast Asia in early 2016 and Chinese Internet giant Alibaba has been taking various actions to make Thailand to be its e-commerce and logistics hub by 2019.

Last mile delivery play field is even more interesting with the competition amongst experienced local firms like Thailand Post; and reputed names in the world such as DHL, Kerry Express, CJ Korea Express, just to name a few. It should be noted that DHL e-commerce expanded operations to Thailand as the first market in Southeast Asia in early 2016 and Chinese Internet giant Alibaba has been taking various actions to make Thailand to be its e-commerce and logistics hub by 2019.

Opportunities for cross-border e-commerce

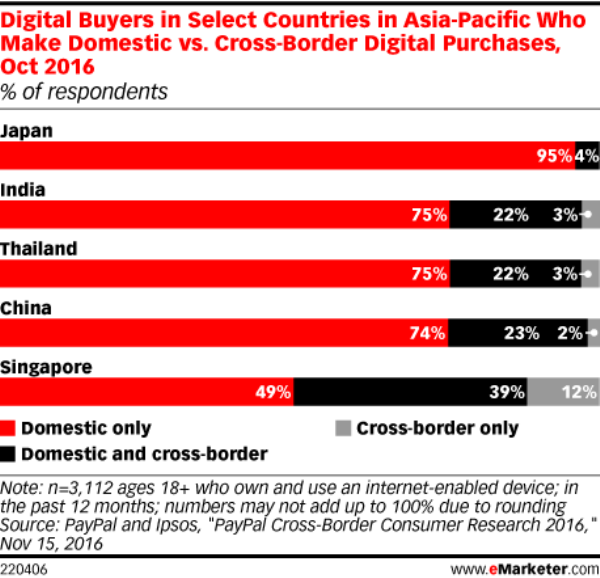

According to a 2016 research by PayPal and Ipsos, 2 million out of 7.9 million online shoppers in Thailand purchased products from overseas websites, mostly fashion, digital entertainment and education and consumer electronics products. No surprising, nearly half (46%) of them place cross-border e-orders via smartphones or tablets. The average share of online purchases from websites outside of Thailand has soared double-digit annually.

However, the development of Thailand cross-border B2C e-commerce is still facing a lot of barriers including customs duties and taxes; long and costly shipping; and inconvenient cross-border online payment. Thai consumers prefer cash on delivery and don’t like credit card much. There is a surge in using alternative online payment methods but not many overseas shopping websites offer suitable options for consumers to choose. Shipping or delivery options share a similar situation when shopping online from another country.

However, the development of Thailand cross-border B2C e-commerce is still facing a lot of barriers including customs duties and taxes; long and costly shipping; and inconvenient cross-border online payment. Thai consumers prefer cash on delivery and don’t like credit card much. There is a surge in using alternative online payment methods but not many overseas shopping websites offer suitable options for consumers to choose. Shipping or delivery options share a similar situation when shopping online from another country.

In order to solve these problems, numerous players have joined this game by offering cross-border solutions for online merchants, including but not limited to logistics and e-payment. Some of the most reputed names are players who provide cross-border logistics fulfillment services like aCommerce, Boxme, DHL. If you are looking for an opportunity to join Thailand e-commerce market, supportive service for cross-border e-commerce is a good choice.

In order to solve these problems, numerous players have joined this game by offering cross-border solutions for online merchants, including but not limited to logistics and e-payment. Some of the most reputed names are players who provide cross-border logistics fulfillment services like aCommerce, Boxme, DHL. If you are looking for an opportunity to join Thailand e-commerce market, supportive service for cross-border e-commerce is a good choice.

In your opinion, which feature is the most important in Thailand digital retail market? Please share with us in the comment below.