Monday this week, the Indonesian government has announced a new threshold for import taxes on consumer goods sold via E-commerce. Instead of the existing threshold of $75, starting Jan 1 next year, any products worth more than $3 (about RP 42,000) will have to pay import tax.

This is the second time that the customs office lowered the threshold in just over a year. Last October, the de minimis rule was changed from $100 to $75 per shipment. These actions are the government’s attempts in preventing cheap foreigns products from dominating the market, leaving room for domestic firms.

->> See more: How Indonesia’s online retail has changed in 2019

Data from the customs office show that the number of overseas shipments has skyrocketed in 2019, from 6.1 million in 2017 and 19.6 million in 2018, to nearly 50 million packages when 2019 doesn’t even come to an end. The rise of E-commerce in Indonesia in recent years has allowed importers to exploit a hole in the country’s import regulations to avoid taxes. Because of the high threshold, sellers don’t buy in bulk anymore. They set up an online shop in order to sell and ship items individually to the customer’s end without having to pay any taxes.

As a result, the market is flooded with foreign goods; and the majority of them are from China which shockingly low prices. Especially for bags, shoes, and fashion items, many local manufacturers have to close up shop since they were not able to compete with the price and the diversity that foreign products offer.

->> See more: E-commerce: now the largest Internet economy sector in Southeast Asia

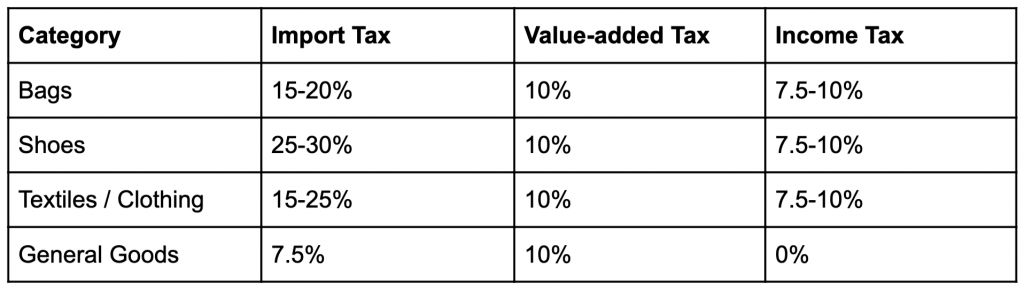

According to the new regulations, foreign-produced textiles, clothes, bags, and shoes worth more than $3 will be subjected to the tax amount ranging from 32.5% to 50% of the total value. For other categories, the tax is actually lowered. Instead of the current rate from 27.5% to 37.5%, general E-commerce goods only face 7.5% import tax, 10% value-added tax and 0% deductible income tax. Details can be found in the following table:

With this action, the price for foreign goods will become significantly higher, allowing domestic goods to survive in this battle. The Finance Ministry will also be monitoring transaction data from online marketplaces like Lazada, Blibli, and Bukalapak to ensure transparency between e-sellers and the government, with pilot projects already running.

References: The Jakarta Post | Jakarta Globe | Aersure

->> You might be interested in: Southeast Asia’s taxing and regulations on E-commerce

Consult with us about selling to Indonesia!

BoxMe is the premier cross-border e-Commerce fulfillment network in South East Asia, enabling world-wide merchants to sell online into this region without needing to establish a local presence. We are able to deliver our services by aggregating and operating a one-stop value chain of logistic professions including: International shipping, customs clearance, warehousing, connection to local marketplaces, pick and pack, last-mile delivery, local payment collection and oversea remittance.

If you have any question about Boxme Asia or how we can support your business, please contact us directly by referring to our hotline. We are glad to be of service!